Russia one of the top five countries for online mobile gaming

For bloggers

Do you want to manage all news about Russia, Africa game Industry? Contact us here mayado@sylodium.com

For companies

Make business in all bilateral trades. Specially from Russia to Africa about Videogames

For Institutions

Tap Sylodium if you are in Russian - African institutional relations (contact us for synergies)

This new is from Inc42.com

India Among Top 5 Countries In Online Mobile Gaming: Report

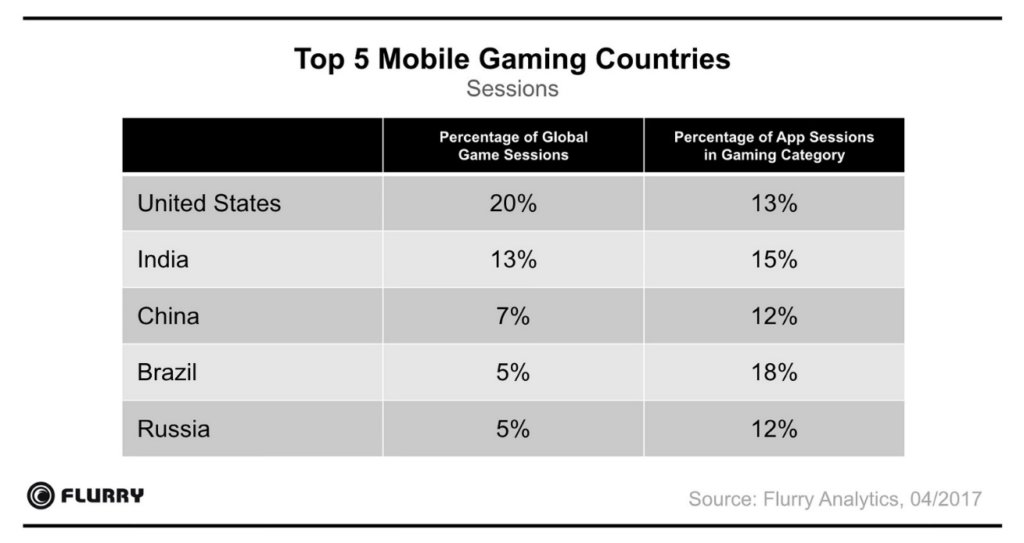

India has emerged as one of the top five countries for online mobile gaming. According to a report by Flurry Analytics, India came in second after the US. China, Brazil, and Russia are the other countries in the top five.

According to the report, the top five countries drive 50% of all gaming sessions in the world. The US, India, and China have taken pole positions for all gaming sessions. Brazil and Russia round out the top five.

The report showcases the online mobile gaming analysis of the these countries on two broad metrics: Global game sessions and app sessions in a gaming category.

Under the first head, the US gained the maximum 20% share, followed by India (13%), China (7%), Brazil (5%) and Russia (5%). However Brazil leads the pack of five with 18% share in app sessions in the gaming category. It is closely followed by India (15%) and the US (13%). China and Russia had 12% each.

The report also claims that the real gaming addicts are coming from Europe. Specifically, Netherlands and Sweden users both spend 31% of all their app sessions playing games. But these countries do not account for all gaming sessions globally. Netherlands accounts for 1% of all global gaming sessions, and Sweden 2%.

Global Mobile Online Gaming: Hitting The Highlights Of The Flurry Report

From Mario Kart to Pokemon Go, Candy Crush and Words with Friends the global gaming scenario is seeing progress. Both in terms of engaging users, as well as the structure and context of the game itself. In such a scenario, Indian gaming developers such as RummyPassion and POKKT are also coming up with new and interesting games to entice users. These developers are going global with their offerings, so it is important to understand the global market as a whole.

The Flurry report has made a detailed analysis and identified global scenarios in segments such as rising/declining gaming categories, time spent in gaming apps, screen size, revenue opportunities and more.

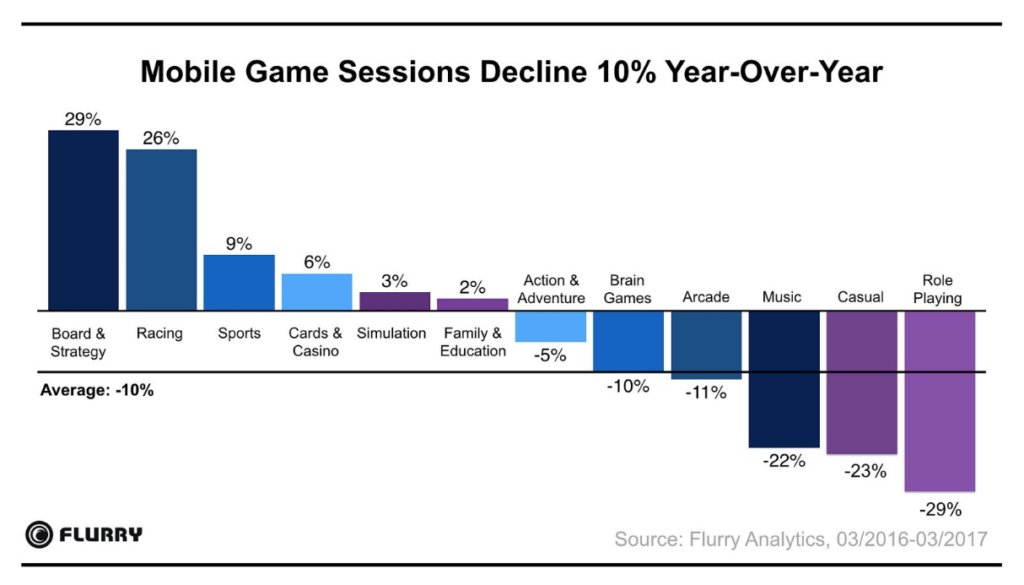

Gaming Categories In Decline

Gaming sessions show a 10% year-on-year decline for the second time running in various gaming categories. The report stated, “Three years ago, arcade, casual and brain games were driving 55% of all gaming sessions. Since then, we have seen substantial declines in two of those categories: arcade and casual games.

Arcade games, which accounted for 24% of all gaming sessions in 2014, decreased by 34%, and casual games by 50%. The declines of those two very large gaming categories were a key factor for the overall game session downturn within the last two years. A lot of those sessions simply dropped and were not spent in other gaming categories.”

Category Winners

Card and casino games have made the most of the decline. They are in the top spot across all three gaming categories – Free, Paid, and Editor’s Picks on the Google Play Store and iOS App Store. “Sessions grew by 22% since 2014, and the category now accounts for 15% of all gaming sessions. Separately, the growth of smaller app categories is driving diversification for the industry.”

The report cited instances of board and strategy games, which grew by 29% Y-o-Y from 2016 to 2017 and sessions are up 80% since 2014. This rise increased the category’s session -share of all gaming apps from 1.6% to 4.0%,” stated the report. The report also suggests that racing games are capitalising on users’ app sessions.

Breaking Down App Sessions

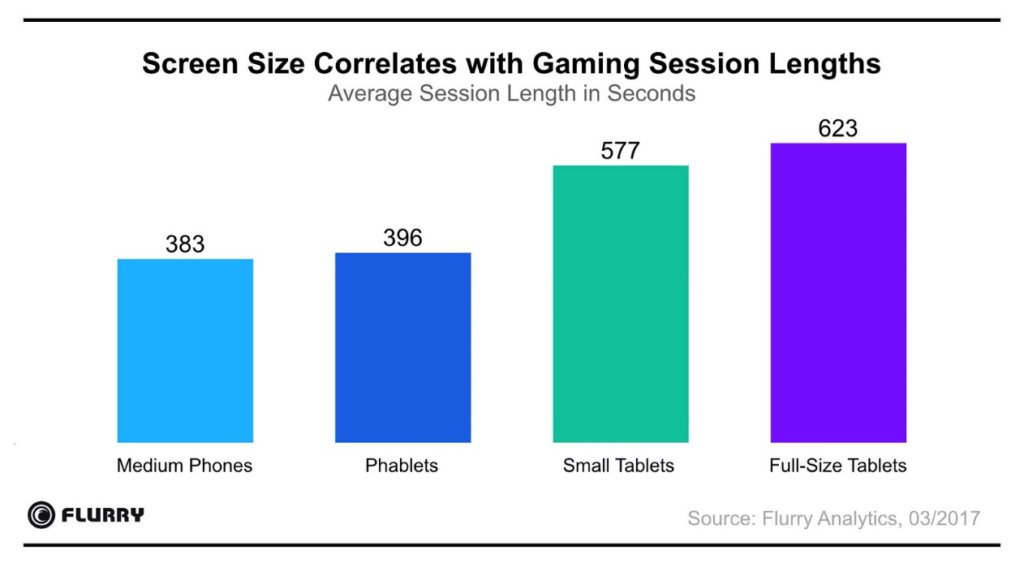

“Flurry data shows that time spent in gaming apps, has remained steady over the last year (+1%). Additionally, the latest year-over-year session length growth equals an increase of 44 seconds (+12%) per session, which indicates higher in-game user engagement than in previous years. These statistics reveal that while more gamers open gaming apps less often, they often spend more time playing games during each session”