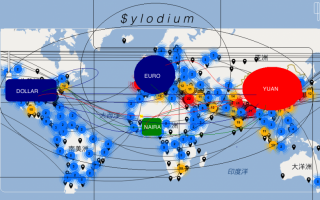

What China does with the Euro that is always following to Dollar?

Is the Euro to Dollar Exchange Rate Doomed?

how did you enter here?

just for casuality?

you are not interested in business or in information?,

Then,

Shouldn’t you leave us?

ok

don’t waste your time,

leave us,

but if you are looking for information for business or to make money?

This should be interesting for you

Make money?

work with us

make business?

Between China - USA

join us and advertise for free in any countries connection

Good ideas about global business or about your country?

participate in our fórum business contest....

The EUR to USD exchange rate is in a correction.

the EUR/USD could fall below $1.1270, at which point, it could exacerbate the euro’s downtrend and push the pair closer to parity.

Indeed, the return of risk appetite generated by good Chinese import-export data prompted an improvement in market sentiment. This has favored a reduction (in short positions) against the dollar, allowing the U.S. currency to achieve its most consistent daily upward growth for more than a month.

On Thursday, the EUR to USD pair continued to reverse the euro’s gains, moving closer to its recent lows with palpable downward pressure.

The obstacle toward parity is that U.S. retail sales data for March turned out to be lower than expected, putting some bearish pressure on an otherwise highly bullish scenario for the U.S. dollar. Also in favor of the dollar is the fact that inflation in the eurozone remains too low for the European Central Bank’s (ECB) comfort.

In the medium and long term, the U.S. has bullish momentum.

the Fed should lift interest rates before the end of April?

This would put more distance between the dollar and the euro, given the ECB’s focus on expansionary monetary policy. Inflation in the eurozone will not suddenly reverse course.

Europe’s reluctant sanctions against Russia, which have cut off an important market from European exporters.

unemployment in the eurozone remains high,

European retail sales were better than expected but growth in the eurozone has remained flat, which leaves the euro vulnerable. If the EUR/USD pair remains at the $1.12–$1.13 level, it’s because growth in the United States was somewhat lower than expected

Tap Sylodium (the global platform for bilateral trade) you can advertise for free your company or your project, at the intersection of cities that you want,

Export-Import Bank of China Plans Dollar and Euro Bond Offerings -- Document

“By Carol Chan”

HONG KONG--The Export-Import Bank of China is planning U.S. dollar-denominated and euro-denominated bond offerings,

The Chinese policy bank, (rated Aa3 by Moody's, AA- by Standard & Poor's and A+ by Fitch), is planning to sell five-year and ten-year dollar senior unsecured bonds,

And three-year euro senior unsecured bond

It also has hired Bank of China, Bank of Communications'Hong Kong Branch, Barclays, Credit Agricole CIB, HSBC and ING as joint lead managers and joint bookrunners to handle euro bond sale, the document said.

Tourism business, import export business, traders, from Pakistan to China….

China EximBank plans dual currency with several countries not to depend of dollar

The Export-Import Bank of China is planning to tap the offshore market with multi-tranche, dual currency senior notes, marking its second direct issuance of offshore debt since its dollar senior notes issued in 2014.

The joint lead managers and bookrunners for the dollar and the euro notes are Bank of China, Bank of Communications Hong Kong branch, Barclays, HSBC,

Citi, Mizuho Securities and MUFG only for dollar

Credit Agricole CIB, and ING only for the euro.

Work with us, representing USA, with rest of the world, for example.

Participate with your ideas and win until 3.000 dollars in Forum-Business-Contest

Nigeria, China currency swap won’t fix FX demand backlog

Last week’s signing of a Yuan swap agreement (fixed amounts for future dates) between CBN of Nigeria and the ICBC of China (the world’s biggest lender), may not ease the current backlog of unmet dollar demand, pressuring on the naira.

A currency swap is an arrangement, between two friendly countries (in this case), which have regular, substantial or increasing trade, to basically involve in trading in their own local currencies, where both pay for import and export trade, at the pre-determined rates of exchange, without bringing in third country currency like the US Dollar.

The reasons of this Swap are,

Eighty percent of trade volume between Nigeria and China consists of imports from China,

“The weakness in the naira is not only in relation to the dollar, but to other foreign currencies. Unless we address the fundamental issue of low exports, not much will change materially,” Yusuf said.

Nigeria should expand the swap agreement beyond China to India, UAE, and other countries that have a healthy trade relationship with the nation, to widen its potential impact.

this will be a clever way of relieving the pressure on the dollar

Make business in China - Nigeria

If you'd want to reach new business realities between India and USA, join us as Premium user to take advantage of our global Barter(transactions), segmentation Banner, and our 2 business networkings

SYNERGIES TO EXPLORE WITH SYLODIUM,

Nigeria-China Business Council

European Union Chamber of Commerce in China

AmCham EU

The European American Chamber of Commerce

Sylodium

Become a Premium user

1 WORK WITH US .

take a look to our coming