The TPP in Latin America and the Caribbean

“International trade now is more complementation than competition. It is because of the forming regional value chains. Before, intermediate goods were just a minority. Final goods were mostly traded. But now, 70 percent or two thirds are intermediate goods,

the TPP in Latin America and the Caribbean

On February 4, 2016, after five years of negotiations, the members of the Trans-Pacific Partnership Agreement (TPP) signed the trade pact, considered to be the highest standard trade agreement to date.

The member countries (Australia, Brunei, Canada, Chile, the United States, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam) account for 40 percent of global GDP, 26 percent of international trade, and 10 percent of the global population

Make business in Mexico – Australia

Make business in Chile – Vietnam. etc

Obviousliy this TPP will have important implications for Latin America and the Caribbean (LAC),

the TPP is contributing to the recalibration of the global trade architecture.

where WTO members adopted the “Nairobi package,”

many countries have turned to regional and plurilateral trade agreements to update their policies and procedures and advance trade liberalization.

The TPP provides an opportunity to deepen interregional trade by creating new market access opportunities in Asia and the Pacific for Latin America and Caribbean, and by upgrading existing relations by including more comprehensive coverage of the trade and investment topics

The TPP includes

elimination of tariffs

trade facilitation

support for SMEs

telecommunications,

trade in innovative services (as digital technologies),

regulatory of competitiveness,

standards on labor and environmental rights, sanitary and phytosanitary standards, and on the protection of intellectual property rights (IPR).

If you'd want to reach new business realities between India and USA, join us as Premium user to take advantage of our global Barter(transactions), segmentation Banner, and our 2 business networkings

Implications for the global trading system

is the increasing importance of global value chains (GVCs) in trade. more and more firms are operating in a variety of countries than ever before

the existence of overlapping rules of origin (ROO)—the rules that determine the criteria for a good to be eligible for preferential treatment under a particular trade agreement—can deter companies from locating production in a certain country and affect the ability of firms to take advantage of preferential market access.

The Peterson Institute for International Economics (PIIE) and the World Bank Research show increase in GDP and in Exports,

they both conclude that the benefits from tariff liberalization, streamlining non-tariff measures, and removing FDI barriers will have positive overall effects for member countries and limit possible negative spillover effects for non members.

the TPP closes a number of “missing links” in the global FTA network.

TPP addresses the need for convergence among the overlapping FTAs already in place.

Finally, it tackles the issues of updating the rules of the international trade game.

The TPP also connects important developing and developed countries (e.g., Peru and Singapore), as well as developing countries with one another (e.g., Mexico and Vietnam).

Ten of the 12 countries have FTAs in place with at least half of the TPP members, and more than 80 percent of trade is already covered under these existing bilateral FTAs.

bilateral FTAs in force among TPP members

advances in information and communication technologies,

improving transportation and supply chain logistics by allowing precise monitoring of the movement of goods throughout the logistics chain,

which makes supply chains significantly more connected and efficient. Similarly, the Internet of Things (IoT) and the advent of new technologies like cloud computing and 3-D printing are transforming trade by removing traditional barriers and creating new channels for trade by allowing previously untradeable products to be moved around the world.

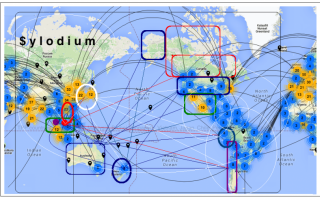

SYNERGIES TO EXPLORE WITH SYLODIUM,

Imagine the relations in TPP

Trans Pacific Partnerhsip Organization

US – Malaysia Business

Peru – Singapore….

12 countries, in mutual relationship suppose 12x12, 144 business places, all of them in Sylodium.

Implications for LAC

Mexico, and Peru had no FTAs in place with important Asia-Pacific players like Australia, Malaysia, and Vietnam.

The TPP effectively closes these gaps

By The PIIE and World Bank studies forecast

Peru is expected to see the biggest increase in its exports, around 10 percent by 2030, while Chile should experience a 5 and Mexico 4 percent

Who knows?

Chile will be able to increase its market access share in Canada, Japan, Malaysia, and Vietnam, and build on its strategic advantages in the food (especially in agribusiness, dairy, and livestock) and forestry sectors, and allow Chile to diversify its export markets.

Non-TPP members in LAC will also be affected once the agreement is ratified. For example, the textiles and apparel sector in the Dominican Republic and Haiti could see an impact on exports due to increased competition from Vietnam,

Brazil, will likely face stiffer competition in Asian markets, where their exports will be competing against countries like the U.S., Canada, and New Zealand.

Other countries like Colombia, Costa Rica, and Panama would be natural additions to the TPP.

Tourism business, import export business, traders, from Korea to Japan from Korea to China….

Work with us, representing South Korea with rest of the world, for example.

Participate with your ideas and win until 3.000 dollars in Forum-Business-Contest

Regional Integration

The Pacific Alliance (PA) comprised of Chile, Peru, Mexico, and Colombia is an example of a forward-looking integration initiative whose goals are in line with the TPP.

Mercosur (Argentina, Bolivia, Brazil, Paraguay, Uruguay, and Venezuela) Exports may be negatively affected by the TPP.

Argentina and Brazil export a significant amount of goods to TPP countries—mainly the U.S., Chile, and Japan. Once the TPP enters into force, Mercosur exporters could be displaced from these markets if they do not comply with the new regulations or cannot meet new standards.

Mercosur would face some challenges since the formation of production chains could tilt in favor of Asian markets and companies from TPP countries.

Mercosur could consider ways in which they can cooperate with the PA initiative.

China

China has trade agreements with 15 countries in the Asia-Pacific region, including half of the TPP members (Australia, Brunei, Chile, New Zealand, Peru, Singapore, and Vietnam), which gives them some advantages similar to those in the TPP.

So China will take a more proactive role in the region in order to continue to influence the standards and rules for trade and investment, and avoid losing market share due to the more dynamic trade linkages generated by the TPP.

Ratification

Before the TPP can enter into force, the signatory countries must first ratify the agreement, meaning the agreement must go through the respective legislative approval process in each country.

Tap Sylodium (the global platform for bilateral trade) you can advertise for free your company or your project, at the intersection of cities that you want,

Become a Premium user

1 WORK WITH US .

take a look to our coming

Revolutionary system for international business in Internet

Mexico city - 28/11/2013

Mexico city - 14/08/2013

Mexico city - 23/07/2013

Mexico city - 23/07/2013

Mexico city - 23/07/2013

Mexico city - 18/03/2013

![[X]](https://www.sylodium.com/img/placeholder-480x480.png)