Start your Tech business 4.0 from China to Africa.

African entrepeneur: your own Business 4.0 at China – Africa

If some investor, or company, or institution accept your 4.0 Tech Idea, from China to Africa, Sylodium guarantees you a reasonable percentage of money with your idea becoming reallity.

China’s tech companies are determined to expand globally, and that determination will only grow

We could say the same of USA, right?

In what Empire do you trust more in relationship with your African country? in USA or in China?

In Sylodium you can choose niches as Shanghai – West Africa FIR gamification, California – Nigeria games 4.0, Hong Kong – South Africa reasonable Industry 4.0, New York – East Africa AI Ideas, FLorida - North Africa IoT-IIoT, etc to dominate them virtually to test real possibilites to start your own business offering your ideas to any American or CHinese investor, company to make money together with us.

Are you in Industry 4.0 from China or USA to Africa?

Our logical business system, allows you to segment your target markets to be seen, and dominate the bilateral trade niches about reasonable mobile gmes from China or USA to Africa you choose.

"You dominate your import-export niches: feel the power"

Why China Is Emerging as a Tech Superpower to Rival the U.S.

New from Fortune.com

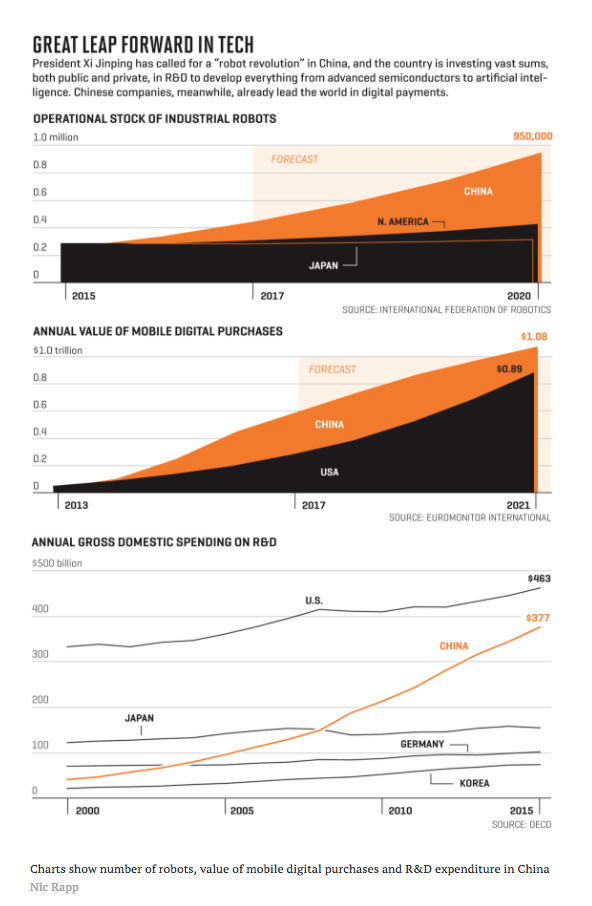

Business in China today, however, is being led by innovation-obsessed execs like Ren Zhengfei, founder of Huawei Technologies, which last year filed more patent applications than any other company in the world. And Allen Zhang, who led the team that developed Tencent’s WeChat, the smartphone app that allows its 900 million users to chat, shop, pay, play, and do just about anything else. And Robin Li, CEO of Baidu, the Beijing-based search company, who has vowed to have autonomous vehicles ready for sale in China by next year.

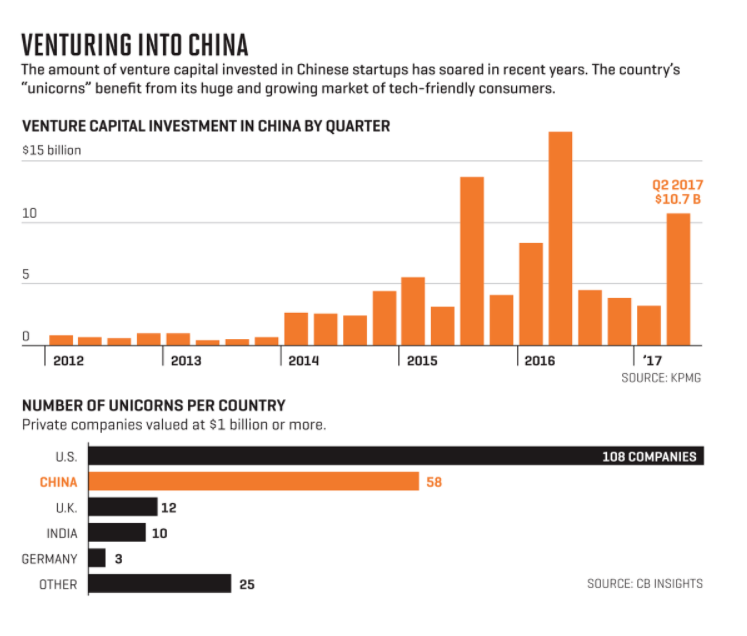

Their success is fueling a virtuous cycle of innovative activity. The country’s two largest Internet companies, Alibaba Group (BABA, +0.96%) and Tencent Holdings (TCEHY, -0.46%), lead the world in e-commerce, mobile payments, social media, and online gaming. They and other Chinese tech giants are investing aggressively in new businesses, helping to transform China into a massive market for venture capital investments. Those ventures, in turn, are nourished by China’s huge and growing market and its unique ecosystem of suppliers, logistics specialists, and manufacturers. The result: China has spawned a new generation of homegrown entrepreneurs who are creating world-class products, developing their own technologies, and rolling out new business models on a scale and with a speed the global economy has never seen. “The copycat era is behind us,” says Kai-Fu Lee, CEO of Sinovation Ventures and the former head of Google China. “We are way beyond that.”

DJI has been hailed by many electronics industry analysts as the “Apple of consumer drones.” But the comparison is misleading. Unlike Apple (AAPL, +1.01%), which proudly proclaims its products are “Designed in California, Assembled in China,” DJI products are designed and manufactured in the southern Chinese city of Shenzhen, which today has no equal for sourcing the rotors, transmitters, batteries, and other components in DJI products.

Meanwhile, Alibaba and Tencent are bankrolling competing dockless bike-sharing companies that launched this year in scores of overseas cities including Washington, D.C.; San Francisco; Nagoya, Japan; Singapore; and Sydney. (In Shanghai, meanwhile, abandoned bicycles from Tencent-backed bike-sharing startup Mobike and Alibaba-backed Ofo have become so numerous that authorities impounded thousands of them earlier this year. Chalk it up to growing pains.) But the two have joined forces in ride sharing. Both are investors in Didi Chuxing, which owns stakes in ride-sharing ventures in Europe, India, Southeast Asia, the Middle East, and Africa.

“China’s tech companies are determined to expand globally, and that determination will only grow,” says Connie Chan, partner at California venture capital firm Andreessen Horowitz. In years to come, she argues, “every company will need a China strategy,” whether they do business in the Middle Kingdom or not.

One of these promising young companies is Toutiao, a news aggregator launched in 2012 by 34-year-old former Microsoft (MSFT, +2.50%) employee Zhang Yiming. Toutiao’s parent company, Beijing ByteDance Technology, already has raised over $1 billion from Sequoia Capital and others, and is seeking an additional $2 billion that would value it at $20 billion. (And in November it agreed to buy U.S. lip-syncing video app Musical.ly for a reported $800 million.) Toutiao uses A.I. to create personalized news feeds of short articles and videos from content generated by its network of 4,000 outside media companies. Analysts say its content-recommendation tech is among the most sophisticated in the world.

It’s quite possible that Toutiao will soon be going head-to-head in the market with rivals from Silicon Valley. If so, remember DJI—and think twice before betting against the Chinese company.